The Best Strategy To Use For Kam Financial & Realty, Inc.

The Best Strategy To Use For Kam Financial & Realty, Inc.

Blog Article

Some Known Questions About Kam Financial & Realty, Inc..

Table of ContentsKam Financial & Realty, Inc. - TruthsThe Basic Principles Of Kam Financial & Realty, Inc. Some Ideas on Kam Financial & Realty, Inc. You Need To KnowKam Financial & Realty, Inc. Can Be Fun For AnyoneNot known Factual Statements About Kam Financial & Realty, Inc. An Unbiased View of Kam Financial & Realty, Inc.

When one considers that home loan brokers are not required to submit SARs, the real volume of home mortgage fraudulence task might be much higher. (https://www.video-bookmark.com/bookmark/6512416/kam-financial-and-realty,-inc./). Since very early March 2007, the Federal Bureau of Investigation (FBI) had 1,036 pending home mortgage scams investigations,4 compared with 818 and 721, respectively, in both previous yearsThe mass of home loan fraudulence drops into 2 wide groups based on the inspiration behind the fraud. generally includes a consumer that will overstate revenue or possession worths on his/her monetary declaration to qualify for a loan to buy a home (mortgage lenders in california). In a lot of these cases, expectations are that if the revenue does not increase to fulfill the payment, the home will be marketed at a benefit from gratitude

The Kam Financial & Realty, Inc. PDFs

The vast majority of fraudulence circumstances are found and reported by the organizations themselves. Broker-facilitated scams can be fraudulence for residential or commercial property, fraudulence for earnings, or a combination of both.

The following represents a case of fraud commercial. A $165 million area bank determined to enter the home loan financial organization. The financial institution purchased a small home loan firm and hired a seasoned mortgage banker to run the operation. Nearly five years into the partnership, an investor alerted the financial institution that numerous loansall stemmed via the very same third-party brokerwere being returned for repurchase.

The Buzz on Kam Financial & Realty, Inc.

The bank alerted its primary federal regulator, which then contacted the FDIC due to the fact that of the potential effect on the bank's economic problem ((https://profile.hatena.ne.jp/kamfnnclr1ty/). More examination disclosed that the broker was working in collusion with a builder and an appraiser to turn residential or commercial properties over and over again for greater, illegitimate profits. In total amount, greater than 100 car loans were originated to one builder in the exact same class

The broker declined to make the settlements, and the case entered into lawsuits. The financial institution was ultimately awarded $3.5 million. In a subsequent conversation with FDIC inspectors, the bank's head of state showed that he had actually always heard that one of the most difficult component of home loan financial was making certain you implemented the appropriate bush to counter any type of rates of interest run the risk of the bank could sustain while warehousing a significant volume of home mortgage fundings.

Kam Financial & Realty, Inc. Things To Know Before You Buy

The financial institution had representation and guarantee stipulations in agreements with its brokers and believed it had choice with respect to the loans being originated and sold through the pipe. During the litigation, the third-party broker said that the financial institution should share some obligation for this direct exposure due to the fact that its interior control systems need to have recognized a financing concentration to this class and set up measures to discourage this danger.

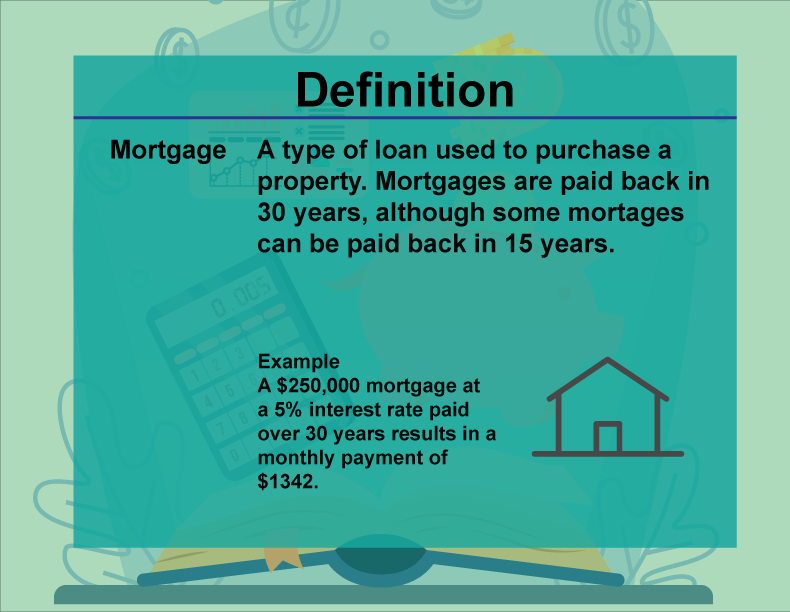

To obtain a much better grasp on what the heck you're paying, why you're paying it, and for how long, allow's damage down a regular month-to-month mortgage payment. Don't be tricked below. What we call a month-to-month home mortgage payment isn't just paying off your mortgage. Instead, believe of a regular monthly mortgage payment as the four horsemen: Principal, Rate Of Interest, Real Estate Tax, and Home owner's Insurance coverage (called PITIlike pity, because, you recognize, it raises your repayment).

Hang onif you think principal is the only quantity to consider, you 'd be neglecting regarding principal's finest friend: passion. It 'd be good to assume lenders allow you borrow their cash even if they like you. While that could be real, they're still running an organization and intend to place food on the table too.

Kam Financial & Realty, Inc. Fundamentals Explained

Passion is a percentage of the principalthe amount of the funding you have actually left to repay. Rate of interest is a percent of the principalthe quantity of the funding you have left to pay back. Home loan rate of interest prices are constantly changing, which is why it's wise to choose a home loan with a set rate of interest so you understand how much you'll pay monthly.

That would certainly mean you 'd pay a massive $533 on your very first month's home loan repayment. Get ready for a bit of math here. Don't worryit's not challenging! Using our mortgage calculator with the example of a 15-year fixed-rate mortgage of $160,000 again, the complete passion price is over $53,000.

Excitement About Kam Financial & Realty, Inc.

That would make your monthly home loan settlement $1,184 every month. Monthly Principal $1,184 $533 $651 The next month, you'll pay the exact same $1,184, however much less will go to passion ($531) and more will most likely to go to this site your principal ($653). That trend continues over the life of your home loan until, by the end of your home loan, virtually all of your settlement approaches principal.

Report this page